According to experts, the definition of mental health refers to cognitive, behavioral, and emotional well-being. In other words, we can say that it is all about your day-to-day conduct, how you think and feel. Until the recent past, mental health was a less addressed issue, which allowed it to bloom behind the curtains of unawareness and social stigmatization. Several factors govern mental health. To name a few, personal and professional conditions, poor performance in academics, poor health. Amongst these, poor economic circumstances is the key player in affecting an individual’s mental well-being.

The COVID-19 pandemic devastated the global economy, which made marginalized sections more vulnerable to its severe impact. A significant chunk of the population lost their livelihood globally and suffered a mental breakdown. Nevertheless, various studies conducted during this period revealed some alarming links between poverty or economic downfall and mental health.

An old proverb says, “We look for a solution to our problem everywhere whereas, the cure lies next to us”. A study conducted by the Social Research and Demonstration Corporation, financially literate people are less vulnerable to mental health issues. Like this, there are numerous studies conducted across the globe, which established financial literacy as a potential cure for mental health ailments such as anxiety, low level of confidence, and depression. Globally, governments and independent bodies have taken various steps to create financial awareness in society.

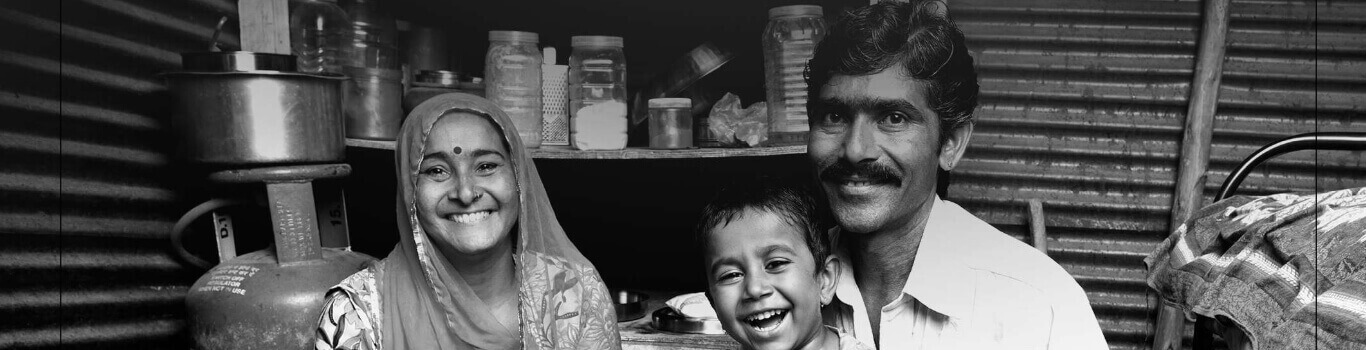

In India, Jaadu Ginni Ka is one such initiative, which is reaching out to people at the ground level and providing them a firm exposure to the basic elements of effective financial awareness. It is well accounted for how the program has helped numerous people to overcome their financial distress and acknowledged the program’s credit for their financial and mental well-being.

Financial literacy does not only provide a person with confidence but also helps in managing his/her budget wisely and eventually leads to a stress-free life. To exemplify, in a country like India, where societal norms are strict and financial strength often associated with the reputation, it is a matter of great paramountcy for a father to arrange a fat wedding function for his daughter. If the person is not financially literate and led his life with a mismanaged fund, it is difficult to arrange an astonishing wedding. Failure to which will eventually result in stress, depression, and other associated issues.

Another factor is the lack of awareness in people. Over two-thirds of the Indian population, which makes a significant portion is still financially unaware and remained unbenefited from most of the government welfare policies.

What is interesting is the increasing number of mental health issues during the pandemic. This surge is an alarm to employ more financial literacy programs to make our society financially literate, which will not liberate us from economic stress but also from mental health issues.